The Reddit IPO is here! What does that mean for you as a Reddit employee?

Prepare for what is coming:

When can you do something with your stock?

How should you prepare before the Reddit IPO?

What should you consider at Reddit’s IPO?

What does it really mean for you post-IPO?

What tax election should I make at an IPO?

If you have double trigger RSUs and an IPO coming up, you may receive a ‘tax election’ from your company. This tax election allows you to decide how much you want to have set aside for taxes on your vesting RSUs at the time of IPO.

For the purposes of this conversation, we will hit on why you might want to choose one tax withholding option over another.

Why do I need to make a tax election at an IPO?

Remember, tax withholding ≠ taxes due. Tax withholding is a required high-level estimate of taxes that needs to be paid into the IRS throughout the year. Even if it feels like you’ve paid a lot in tax withholding, you may still owe more at tax time.

Do you want a refresher on double trigger RSUs and an example of the tax breakdown? Check out our post What are Double Trigger RSUs and how are they treated?

Should I choose to withhold 22% or 37% in Federal taxes from my IPO vesting?

It depends. How much you withhold for taxes depends on how you want to think about your stock and what your total income for the year will be.

Some individuals view 37% withholding as ‘leaving gains on the table’ for shares that *could have* appreciated. Some individuals view 22% as being a big risk that they may have to sell more shares to cover a tax bill if the stock price goes down.

We encourage you to consider this using examples of what that risk might be for your own situation.

Examples of taxes at an IPO

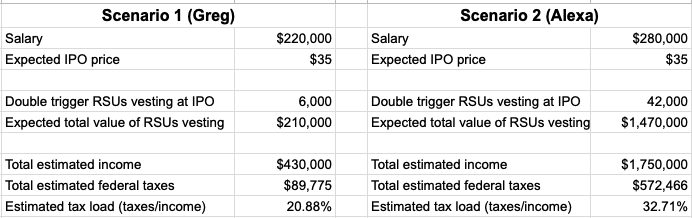

Let’s choose two situations. The first scenario is for Greg and the second scenario is for Alexa. We assume that both Greg and Alexa have families and are expecting an IPO to happen at year end. This IPO will help them each with buying their next home and getting closer to financial independence. The biggest difference between them is that Greg started at the company as an IC and Alexa came on as a Director. What could their taxes look like?

By estimating what their total income for the year will be and the taxes due, we can get an idea of what their estimated tax load (aka ‘effective tax rate’ may be).

Other considerations for estimating taxes

Some bigger pieces we are leaving out of these examples are:

If your salary is low, chances are your withholding on your salary is much lower than needed at the IPO. Salary withholding tables were made by the IRS assuming your salary is your main income. It matches tax withholding requirements with that income expectation. If both spouses are working, this effect is magnified.

If you have ISOs or NQSOs to consider, the math gets way more complex. We recommend working with your tax advisor or financial planner to create the best strategy for you.

Other sources of income may change the math as well. If you do consulting on the side, have other IPOs in the same year (yes, this has happened to our clients in the past!), or long term rentals, then you will need to up your estimate.

Now let’s see how the 22% and 37% tax withholding election could work out for them.

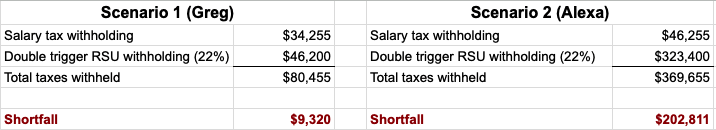

Examples at 22% tax withholding

This is where total estimated income and the effective tax rate matter. Let’s break down the withholding made a bit further between salary and the RSUs vesting at an IPO.

In this case, the difference in total income makes a huge difference in how much more they will still owe come tax time. Greg may view the risk of $10,000 needed in cash to cover the shortfall as ‘worth the risk’ or up his withholding in case the stock price drops. Alexa’s shortfall could be catastrophic if she isn’t ready to pay $200,000 at tax time.

What are the downsides to taking on the risk of lower tax withholding?

This comes down to what you can afford to take risk wise and what you can’t. Greg may have $10,000+ in cash savings annually and see this as a high risk/high reward worth electing the lower 22% tax withholding for.

Alexa may not have $200,000 laying on the sidelines to pay her taxes with. Even more importantly, what if she did??

Each IPOing employee in this situation should ask themselves:

1. If you sell more for withholding now and it goes up, how would you feel?

2. If you don’t sell enough to cover taxes now and it goes down, how would you feel?

In Alexa’s case, how would she feel paying $200,000 in to cover taxes only to see the stock tumble? If the answer is 🙁, then Alexa should select 37% withholding.

Another consideration is the lockup period. Most IPOing companies have a 180 day lockup period (with some caveats). I don’t have data on how IPOs tend to look 6 months out, but there is a great study at NASDAQ on what happens to IPOs over the long run. Long term, the majority of IPOs do not perform well and drop below their IPO price. This is something to consider in your risk assessment.

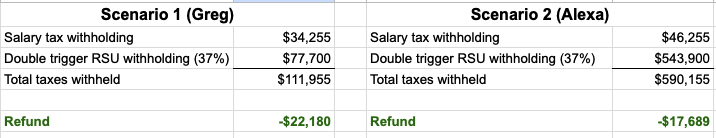

Examples at 37% tax withholding

What would happen in each of these scenarios at 37% withholding? Each would end up with a refund after filing their taxes.

I like to think of this as selling some shares at the IPO price – because that is effectively what will happen. 🙂

Through these two examples, you now have an idea of what a 22% tax withholding rate vs 37% tax withholding rate might mean for you. The important thing is that you know what to expect – uncertainty and big tax bill surprises can take the fun out of your Company’s IPO.

Interested in learning more? Sign up for our newsletter

The above discussion is for informational purposes only. Recommendations are of a general nature, not based on knowledge of any individual’s specific needs or circumstances, and there is no intent to provide individual investment advisory, supervisory or management services.

What are Double Trigger RSUs and how are they treated?

Double trigger RSUs are a popular type of stock compensation leading up to an IPO. They are better for the employer – who doesn’t need to recognize stock expenses until IPO. They are less mental energy for the employee – who doesn’t have to pay taxes or make sell decisions until IPO.

What is the difference between single-trigger and double trigger RSUs?

How does double trigger vesting work?

What happens to a double trigger RSU at an IPO?

Does my company pay my taxes on the double trigger RSUs at vest?

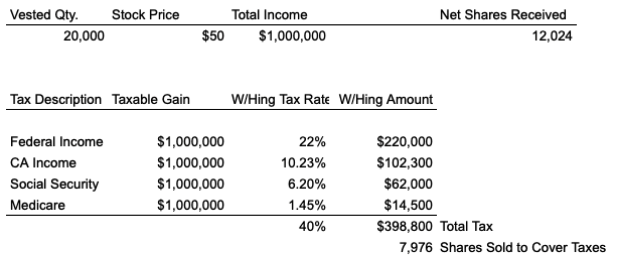

What is an example of taxes on a double trigger RSU?

Here’s an example of what it might look like.

When double trigger RSUs vest, you will want to make sure you account for this as you decide what to do with the shares.

Do I owe taxes on my double trigger RSUs if I hold onto them after the IPO?

Do I owe taxes on my double trigger RSUs if I sell them after IPO?

What happens to a double trigger RSU if you leave?

- If you have double trigger RSUs that are not time vested, those will expire immediately.

- If you have double trigger RSUs that did meet the time vesting component, it may depend more on whether termination was ‘for Cause’.

- In this case, ‘for Cause’ termination may result in complete termination. ‘Not for Cause’ termination is gentler and usually allows you to be eligible for the time vested RSUs to vest at IPO or exit.

What should I do if my startup announces a tender offer?

What does it mean for my startup to have a tender offer?

A tender offer is a startup’s way of providing liquidity to employees and offering shares to others. Often we see this start to happen as the company gets closer to IPO or decides to delay IPO. In part, this helps employees see the value of their hard work and in part helps the company provide stock to potential investors.

Generally, we see startup tender offers limited to a maximum of $X or Y% per person. The more common caps we’ve seen are up to $1 million in value or 50% of stock outstanding. This is because tender offers are generally fueled by investor money or profits and so there is a total cap. If the tender offer is ‘oversubscribed’, that means there is more demand for tendering shares for cash than can be fulfilled. In this case, your total request of shares to be bought back may be further limited.

Review your personal financial situation to decide whether participating in the tender offer is right for you.

- Are you hoping to buy a new home?

- Are you expanding your family and want to get a head start on college funding?

- Will you be leaving the startup soon and need to plan for a potential clawback?

- Do you want to exercise more stock options and are facing a cash crunch?

- Do you want to diversify out of your startup stock a bit for future flexibility?

There are many opportunities in selling back some shares in a startup tender offer. Other questions can be found in our tender offer basics post.

What should I consider during a tender offer?

- Why is the company doing a tender offer? Is this an opportunity for investors to get in when they believe the stock is undervalued? Or is this to provide liquidity while waiting for IPO/M&A?

- What is the valuation the shares are being offered at? If the shares are ‘underwater’ i.e. under the exercise price for options or RSU vesting price, you may feel differently about tendering the options. Generally, there is no reason to tender stock options under the exercise price.

- How do I feel my company is doing? Are you surprised at the valuation? Do you see a long road ahead for the company? Or do you feel the company is at a lower point now with the right metrics to get it to an even better Series XYZ in a year or two? Although your assessment is biased, it is something to consider and weigh the risk / reward of keeping more shares. I like to ask the question as: If you had the value of what you expect from the tender offer in cash, would you buy company stock with it?

- What are the tax implications? Each type of stock option and currently held share may have different tax implications in a tender offer.

- Which experts are in my corner to make sure I am considering the implications? Consult with your financial advisor or tax advisor to plan for the best outcome. If you are looking for guidance, schedule some time with us to think through options HERE.

What are the tax implications in tendering my shares?

- Unexercised stock options: the difference between the sales price and exercise price will be treated as ordinary income (compensation)

- Exercised ISOs:

- If held short term or less than 2 years from grant date, this would disqualify the special tax treatment and turn it into an NQSO sale. We rarely recommend doing this since you may have already paid AMT taxes at exercise and will not be able to get a credit back. This will be treated as ordinary income (compensation)

- If held long term, this will result in long term capital gains/losses

- Exercised NQSOs: short term or long term capital gains/losses

- Vested RSUs: short term or long term capital gains/losses

- Unvested RSUs: these are generally ineligible for tendering

Beyond what type of income or gains/losses each type of stock will be, there is also the question of who is paying any taxes due to the IRS and state tax department. We suggest reviewing your paystub post-tender offer to see what came through the paystub vs. what did not. You will be liable for the taxes in the end, so it is better to know now than when you file your tax return.

Is a tender offer better than an IPO?

Startup tender offers can be rewarding and less stressful. Instead of watching the market daily while you wait out your lock up period, a tender offer allows you to review your finances with a known price. It is a great way to financially profit while waiting for an IPO or Merger to happen “one day”.

I love it when a long-time startup employee comes to us with RSUs and ISOs in a tender offer. Then, we work together to find the best strategy based on their situation. Our goal is to understand where you want to be financially and keep it front in center. Then, we balance tax implications, risk exposure, and long term growth at a level you are comfortable with.

For many of our clients going through tender offers with RSUs and ISOs we are able to purchase ISOs, minimize AMT taxes and diversifying out a large portion of cash from the event. This makes my heart sing for my clients!

Can a startup force a repurchase of shares?

This is often called a ‘Clawback provision’. If a startup includes a clawback in the plan documents, the company may be able to repurchase shares at termination or in the case of an exit. Typically, the buy back will be at the fair market value of the shares at that time and can prevent you from realizing the full value of owning the shares.

An example of the downside of clawbacks can be seen in the Skype acquisition by Microsoft. Read more about it HERE and see some in depth examples HERE.

Another example of a clawback in action is if you make an 83(b) election and leave before your shares fully vest time-wise. The company typically has 90 days to repurchase any of your unvested shares at the same price you paid.

Those are the most common examples of a forced buy back, but not something we commonly see occur as part of a tender offer.

In the end, the best plan for a startup tender offer is the one where you decide how this event can get you closer to your financial goals.

If you are looking for a thinking partner in how to optimize and streamline your finances, schedule some time to chat with us.

Interested in learning more? Sign up for our newsletter

The above discussion is for informational purposes only. Recommendations are of a general nature, not based on knowledge of any individual’s specific needs or circumstances, and there is no intent to provide individual investment advisory, supervisory or management services.

Should I opt into the Google Employee Trading Plan?

The Google Employee Trading Plan is a 10b5-1 plan that allows you to set up a trading program outside of the annual trading windows. It also helps alleviate the pressure to sell at the right time or to need to make a decision every time the stock vests.

The trading plan starts with a cooling off period where you cannot sell stock for a few months and then goes into action in August. The plan will continue until July the following year.

There are many options within the Google Employee Trading Plan for selling prior vested GSUs and future vestings (starting with August). If you do decide to sell prior vested GSUs, there will be an option of which shares to sell and how to sell them. Two of those options are FIFO and LIFO. FIFO means selling the shares you first received long ago and still hold. This will sell long term held GSUs. LIFO will sell shares most recently vested. Prioritizing recently vested shares may result in short term capital gains that are taxed at higher tax rates.

What should I consider?

When you are thinking about whether to opt into the plan, a few factors to consider are:

- Company performance

- Stock volatility

- Need for diversification

- Trading plan restrictions

- Your financial plan

Below are a few of the thoughts we take into consideration of our clients when reviewing whether the plan is helpful for them.

Why opt into the Google Employee Trading Plan?

Company performance: If you don’t believe in forecasting or don’t know what to expect, then you may want to capture it systemically. You may also review trends and see that the stock tends to drop after trading windows open for employees.

Stock volatility: If the changes in stock value makes it hard to sell, you may want to opt in to the trading program to reduce decision fatigue.

Need for diversification: If the majority of your net worth is from vesting GSUs, then you may wish to diversify your portfolio or add liquidity. Trading windows would restrict when you could use the money.

Trading plan restrictions: If you live in a more expensive place, you may need to use some shares for mortgage payments and living expenses. A trading program using VWAP will allow you to receive the cash from each RSU vesting on a monthly basis to align with your spending and savings.

Your financial plan: Opting in will allow you to build a snowball of selling shares and putting the cash towards your investments and life goals. This may mean saving more towards a home, expanding your family, supporting parents, or leaning into investing in owning your time in the future.

Why not opt into the Google Employee Trading Plan?

Company performance: If you think Google is riding the wave of AI, user growth, and is going to kill it this year, then you may believe in timing a sale. You may decide to review financial performance and news after each trading window opens up to determine what you want to do.

Stock volatility: If you prefer to attempt to ‘game’ the volatility and sell on a local high within the trading windows, then you may want more control than a trading plan offers.

Need for diversification: If you prefer to take the risk of maintaining your career and investment portfolio all with one entity.

Trading plan restrictions: If you don’t need the shares for living expenses or an upcoming purchase. Or, you may want the opportunity to change your mind on selling previously vested GSUs through the year.

Your financial plan: If your financial philosophy is about placing big bets in the hope for big returns and grinding until that point, then you may not see a need to opt in. Caution: this is more of a speculative decision than a financial plan.

Our recommendation

When you want to streamline your finances and add clarity to your life, a trading plan frees you emotionally and timing wise. You are able to flex your financial freedom muscles knowing each month you are getting closer to your financial goals and a stable future.

The employee trading program can be freeing for most financial plans. You are able to take the compensation you’ve earned and use it towards investing in yourself, your family, and your long term success.

That is our philosophy. What is yours? What is money’s purpose in your life?

If you are looking for a thought partner in your financial life, schedule a chat with us.

Interested in learning more? Sign up for our newsletter

The above discussion is for informational purposes only. Recommendations are of a general nature, not based on knowledge of any individual’s specific needs or circumstances, and there is no intent to provide individual investment advisory, supervisory or management services.

Exercising Stock Options Pre-IPO

Exercising stock options pre-IPO means evaluating risks and rewards.

- What will happen to the stock over time?

- Will the Company continue to do well?

- When could an IPO happen?

- How long might the stock remain illiquid/unable to be sold?

Once you evaluate your risk, then it’s about understanding the ramifications of exercising the stock options.

What are stock options?

There are two types of stock options: Incentive Stock Options (“ISOs”) and Non-Qualified stock Options (“NQSOs”). Each is considered valuable as the company continues to grow. If the Company does well, the value of your options will increase and (hopefully) so will your personal net worth. However, it is important to consider the tax ramifications.

Incentive stock options (“ISOs”) are stock options available under a company stock plan. Qualified ISOs receive favorable long-term capital gain tax rates upon sale instead of ordinary income rates. In order to qualify, they must be held one year from the date of exercise and two years from the date of grant. Otherwise, they are considered non-qualified stock options (“NQSOs”).

In the year you exercise ISOs, you may be subject to the alternative minimum tax (“AMT”).

If you have NQSOs, exercising shares may trigger regular income tax. The difference between the ‘market value’ and exercise price is compensation and generally shows up on your W-2 in the year exercised.

What happens when you exercise pre-IPO options?

When you exercise pre-IPO options, you are purchasing the shares at the exercise price in order to own the shares outright.

The year you exercise pre-IPO options, you will pay the exercise price and pay any taxes due from the exercise. Depending on the price, you are potentially paying taxes now to avoid more taxes in the future.

This generally works if the company continues to grow well and the shares increase in value. The downside is that not all companies continue to do well and sometimes it can take years before you can sell them.

What is the best time to exercise stock options?

It is important to decide how much cash out of pocket you are willing to put towards purchasing shares and paying the taxes. You have no idea when you will be able to sell – so ‘betting’ on your ability to pay is a no-go.

It is also a good idea to consider the risk of the company. Are they at Series B and struggling to meet growth expectations? Or are they at Series F with institutional investors and continuing to scale well/be profitable?

In other words, how much cash out of pocket are you willing to lose?

Once you are comfortable with the potential loss, you can determine other types of timing.

When you join: If you join a very early stage company, there may be a chance to file an 83(b) election with little cash out of pocket. This may help to start your time period for claiming capital gains treatment or the qualified small business stock exclusion (‘QSBS’). Read more about the qualified small business stock exclusion here. The downside is, you know very little about the company at this point. If you decide to terminate before your vesting period is done, you may lose out on some shares you already paid for. An 83(b) election should be used with care.

Down-turn in the market: If the downturn in the stock market lasts a while, tech startup valuations come due. The new 409A valuation may end up lower based on expectations in the market. If it looks like they will weather the storm and do well, this could be an opportunity to purchase the shares at a lower tax due.

Before the next fundraise: If a fundraise is expected, you may wish to purchase some shares before it closes in order to minimize taxes. Generally, upon a closing of a funding round, the share price must be reset based on the value the new investors assigned to the company.

Note: Beware the cap table lock period. This is the time when fundraising commitments are being incorporated into the cap table to know where everyone stands. If you wait too far into the fundraise, you may not be able to exercise shares during this time.

At S-1 filing: When the company has committed to the process of IPO, this may seem the least risky time to exercise shares. The risk is in what price/value it will be on the stock market and taxes, but it is at least becoming more liquid.

Again, beware the taxes!

For example, let’s say you were granted 100 ISOs on May 1st, 2021 and then you exercised them May 1st, 2022. You ended up paying AMT on those 100 ISOs in 2022 because the stock price went up significantly over that time.

Then, the company IPOs at year end, and you are able to sell some in January 2023. The ISOs sold will be considered NQSOs because they were not held 1 year from purchase date / 2 years from grant date.

So in 2023, you will pay taxes on them as W-2 income, but there will be no way to get back the AMT you paid on your 2022 tax return. This is when you hear about people who ended up paying 70%+ in taxes on their shares. Please involve a tax advisor!

This is why it is important to hold the ISOs for the required time period. If you sell them before the 2 year grant/1 year purchase date, you could end up paying AMT in one year and regular taxes the following year. Ouch.

A basic discussion of AMT and exercising stock options is HERE.

At Termination: Your ISO shares generally expire within 60 to 90 days following termination (check your plan document). If you do not exercise them, they may turn into NQSOs eligible for a future exercise, or completely expire. For our thoughts at termination, check out our post on What to do with stock options at termination.

At SeedSafe, we tend to look at ISOs over each year to understand what is best to do in the current environment.

When should I exercise ISOs this year?

As you save more money and are able to take a little bit of risk, then we recommend looking at exercising ISOs during each year. Think of it as dollar-cost averaging into your stock.

Spring: Consider an initial round of ISO exercises at a conservative level. The goal here is to maximize the AMT exemption based on $X to be used towards stock and income expected for the year. Once maximized, then you can consider the trade off in exercising more (depending on stock price & other factors).

The hard part for tech professionals is that your stock compensation doesn’t stay static during the year. What may look like $200,000 in stock compensation for the year could drop to $50,000 or go up to $400,000 and completely change the math on what an ISO exercise will do to your tax bill. This is why it is important to look at the risks and run a few scenarios to decide what risk you want to take.

Winter: This is a great time to do a wrap-up on how the year went financially and to decide if it makes sense to exercise some more shares. This is the time when calculating the tax bill will be easiest. More knowns means fewer surprises For other year end tax tips on stock, check out our article on Year End Tax Planning for Stock.

If you’d like a thinking partner in considering the risks and rewards of stock options, please schedule some time with us. We love helping tech professionals think through what the stock can do for them and what their trade-offs are in exercising or not.

The above discussion is for informational purposes only. Recommendations are of a general nature, not based on knowledge of any individual’s specific needs or circumstances, and there is no intent to provide individual investment advisory, supervisory or management services. You should consult a legal or tax professional regarding your individual situation.

What Happens to my Stock in an Acquisition?

Tech professionals have such an interesting life from a stock perspective. You work hard to understand your offer letter, these weird stock things, and what that means from a tax perspective. The fun doesn’t end there – now an acquisition turns your beautiful plans into reality!

What happens to your stock in an acquisition depends on a few things.

- The kind of acquisition it is

- The structure of your company

- What kinds of stock and/or options you have vested

Types of Acquisitions

Acquisition Type – LLC or Partnership

These can be quite a bit trickier. An LLC or partnership may be acquired for their stock or for the assets within the LLC/partnership.

If the LLC / Partnership is acquired by an ‘asset sale’, then your next K-1 will show the character of those gains. This may include: capital gains, ordinary income, interest income, debt cancellation, etc. It may be harder to estimate the impact of the sale. We recommend reaching out to your tax advisor for more information in this situation.

Acquisition Type – C Corps

Let’s say Company X is going to buy Company Y.

Company X will offer a ‘purchase price’ and this can be made up of a few components:

- Cash,

- Company X stock, and/or

- Promissory notes

Depending upon the offer components, this will trickle down in what you personally receive for stock held.

Retention bonuses or retention stock grants will be made to individual star performers. The goal is to retain employees to ensure a smoother transition into owning Company Y.

Many executives find themselves terminated in the acquisition, so review your original contract for an acceleration clause. Does this sound new to you? If so, then we recommend negotiating this in your next compensation package. Find out more here.

What happens if I own stock in a company that gets bought out?

When you own stock in a company, stock certificates will be exchanged for either cash, cash and stock, or stock. It doesn’t matter if the stock is acquired through vesting RSUs or exercising stock options.

Most of the Big Tech companies tend to purchase startups for all cash. Smaller tech companies, who are acquiring another company for technology or market share, may not have the cash to put down. In those cases, a cash and stock purchase makes more sense.

Generally, the timeline goes like this:

- Your company notifies you of the acquisition

- You parse through legalese to understand if it is a cash purchase, stock and cash purchase, or other type of purchase

- There will be an estimated closing date announced where the majority of the transfer will occur (generally within 6 months)

- You will be subject to an ‘escrow’ where a certain % of your stock is held until all expenses are settled (within one to two years)

If you acquired the stock long ago, this is the time to review whether you meet the Qualified Small Business Stock exclusion. Read our blog post about it here.

If you exercised options in the last year, you will want to understand what that means for you tax-wise. One of the down sides of exercising ISOs is when you decide to take on a big AMT tax bill in hopes that the price will rise. Only, you find out your company will be acquired less than a year later. In that case, you have a big AMT credit and not a high chance of recouping it. Whomp whomp.

Any cash received will be considered a ‘sale of your shares’ and taxable at the time of the acquisition.

Stock and cash received for your company stock will be taxable to the extent cash was received.

A stock for stock transaction means your original basis and purchase date continues on. This will be portioned between the new amount of shares received by the acquiring company.

Clear as mud? Then it’s time to schedule an introductory meeting with us so we can chat through your particular situation.

What happens to my stock options in an acquisition?

Your stock options may go through a similar process, but on the original vesting timeline.

If you hold vested stock options, the company may pay out cash for these or provide you with a new grant in the acquiring company.

Once the acquisition is announced, you will no longer be allowed to exercise stock options. So if you see a lot of closed doors and people you don’t know coming into the office, that may be a sign to ask what’s up and consider your options 🙂

What happens to my future vesting schedule?

If you have unvested stock options or RSUs, these will move to either future cash payouts or new grants of the acquiring company stock.

You may also receive a retention bonus or retention stock grant as a way to motivate you to remain with the acquiring company for 2 additional years.

Should I sell my stock after acquisition?

If your company is acquired for stock, and it is priced very well, consider selling a large chunk. Many announced acquisitions bring the speculation of a beautiful future together and help buoy the stock price.

Most likely, if your company is being acquired, you had a lot of illiquid shares that were more ‘paper money’ than real money. Now is the time to make the most of the opportunity. Prepare for your future by investing in the stock market and considering your options for furthering your community.

Depending on the type of sale, you may have a great opportunity to do some gifting and charitable contributions with stock to minimize taxes.

Congratulations on your acquisition! If you need any help, please schedule some time to chat with us. 🙂

The above discussion is for informational purposes only. Recommendations are of a general nature, not based on knowledge of any individual’s specific needs or circumstances, and there is no intent to provide individual investment advisory, supervisory or management services.

Carta is a tool, but not law

As a financial planner, I love Carta. It is a great tool – no more paper share certificates or poorly scanned copies of stock agreements. Everything is in one place and Carta has a great estimator for ISO exercises. So cool, but it is not law. It still requires the correct inputs from your tech company and you.

This year, we had some new clients come to us who use Carta for their stock options and had some issues. The frustration and anger I feel on behalf of my clients is requiring a bit of a rant below. Here are our best tips for successfully navigating Carta.

What does Carta do?

Carta allows your tech company to easily maintain their cap table, stock plan documents, and equity grants. Carta also allows you, the tech professional, to see all your lovely grants in one place. It even allows you to connect your advisor. That way, you can create a strategy together (instructions HERE if you are interested in connecting your advisor).

Logging into Carta

When you log into Carta, you will see a ‘portfolio overview’ of your current (and past) employers where you have stock or stock options available. You can view any tax forms under the ‘documents’ section and view ‘Account’ to see your exercise history and personal settings.

If you dive deeper on a specific company, you will see your holdings, your option grants, and what is available for exercise. There is also a lovely option to view the exercise simulator in Carta.

Looking Deeper into the Carta Exercise Simulator

I have a love/hate relationship with the exercise simulator. So when I get frustrated, I take a deep breath and remind myself that it is a tool, but not the law.

The exercise simulator is a very rough estimate. It requires two major things to even be a rough estimate:

1. Your company must have updated Carta with the correct FMV of the stock.

This is huge. HUGE. We’ve had clients find out that they exercised ISOs on Carta when it said $X FMV per share when in reality it was $Y FMV per share. Before you go through any exercise on Carta, please check within your company for the correct FMV per share.

This could be as simple as sending the CFO or Comp Manager a quick email: “Hey _____, I want to double check that Carta is correct before I request an exercise of my options. Is the listed FMV of $X still accurate?” This may save you $30,000 in AMT or even $200,000 in AMT. I’ve seen it happen. Want to learn more about alternative minimum taxes “AMT”? Check out our post HERE.

Please don’t let this be a surprise to you when you receive the IRS Form 3921, Report of your exercise of incentive stock options, after year end. It is entirely possible this form will show a different FMV per share than Carta did when you ran the exercise through their system. If your tech employer is a startup, the person in charge of updating Carta may be overworked and understaffed, so an update to Carta could be a low priority until it’s too late.

2. You must accurately estimate your taxable income.

To get a rough estimate in Carta, it is also dependent on you adding in a small little request of ‘what is your taxable income?’. If you forget about a large stock grant for the year, a bonus, a spouse’s income, or some capital gains you plan to realize, then the estimate will mean nothing.

If you do estimate your taxable income well, the estimate may still be far off if you are able to sell previously exercised ISOs in the same year. ISOs go into the alternative minimum tax equation at exercise and at sale. This is a time to go run an estimate with your tax advisor.

Keep your Address Up-to-date

Prior to exercising shares or selling shares, we recommend making sure your address is accurate within Carta. Some states/local jurisdictions may view ISO exercises as taxable and a mandatory tax withholding may pop up. It is best to know this surprise won’t happen and the income won’t be coded to a city/state you do not live in on your W-2.

Selling Shares through Carta

If your tech company offers a tender offer through the system, we recommend downloading every confirmation of sale. Carta does not have an easy place to find a ‘tax basis’ report within the tool. This could leave you in a tax cash crunch if you cannot prepare.

This will be on you and your advisor to construct and maintain a cost basis report so you know what your taxes look like as you are exercising and selling stock options.

Please don’t end up like the pig above. Please use the exercise simulator with care. Carta is a beautiful tool, but it is not law.

#endrant

The above discussion is for informational purposes only. Recommendations are of a general nature, not based on knowledge of any individual’s specific needs or circumstances, and there is no intent to provide individual investment advisory, supervisory or management services.

What should I do in a down market?

This summer was the first time in a few years ravaged by COVID that we could finally go out and play as a family again. It also was a time for a down market to hit. Higher gas prices and inflation nipping at our heels wasn’t fun to witness while traveling.

A down market feels risky and unknown. Leading to further questions about: How can I prepare during this time? Where should I be putting my money? Should I be selling my vested company stock / RSUs?

How can I prepare during the down market?

Now is the time to reassess your family burn rate. Those tried and true words of ‘always have an emergency fund’ rear their head again! Are you living within your salaries? Do you require additional funding from your RSUs or stock options? How can you give yourself the most leverage to ‘wait out’ this season of a down market.

Consider tracking your expenses through a budgeting tool like YNAB or mint.com. Even if you don’t follow a budget to the law, this will let you see a good trend line. If you’d like something more manual, you can use this handy spreadsheet to catch some of those non-monthly items that stack up.

Knowing your burn rate gives you the freedom to realize other opportunities.

If your burn shows you have a risk in not having enough cash, this also gives you time to build up your cash reserves. The rule of thumb is if you are a single breadwinner, 6 months of reserves is best. If you are a dual income family, then 3 months may be adequate.

Tax-loss harvesting. The ability to take advantage of tax losses on your tax return is a pretty significant opportunity, especially for folks with large portfolios or equity comp. Tax loss harvesting works by selling assets at a capital loss and using that loss to offset other capital gains. This type of strategy can only be employed during down markets or high volatility in an asset class. During years such as 2022, you may be able to harvest a good amount of losses to help smooth and optimize your tax bill.

This gets into a very technical zone to do yourself. The loss must have substance to be utilized. I love this super nerdy and well outlined discussion from Kitces on who benefits best in this situation (with visuals) and the pitfalls if you are attempting this yourself.

Converting IRA funds to Roth IRA accounts. Depending on your taxable income for the year, there may be an opportunity here. The primary advantage of Roth assets is their current tax-free nature in growth and qualified distributions. This conversion will generate taxable income now, on hopefully ‘lower priced’ assets than if you did the conversion in the future. In essence, you choose to pay a tax bill now rather than in the future. One of the variables you should be mindful of is the Federal & State marginal tax bracket and your effective tax rates. Please consult with your tax advisor before engaging in this strategy.

Where should I put my money in a down market?

Once you know your burn rate and cash on hand, any remaining cash can go towards future growth.

If you have a big purchase to make in a few years, you may wish to take less risk in your investments and go for a well diversified stocks and bonds portfolio.

If you have cash on hand that you believe you won’t need for many years, this may be a time to look at exercising lower valued stock options.

Exercising incentive stock options (ISOs) in a down market

One of our favorite opportunities to explore during down markets is the exercise of Incentive stock options (ISOs). This strategy is a concentrated risk that requires a strong understanding of how much cash you are willing to lose. Once you know how much cash you are willing to ‘lose’ towards such a risk, you can consider the options below.

- Private companies: If your company is private and they take a “down round”, employees with Incentive stock options (ISOs) may have an opportunity to get a bigger bang for their buck. ISOs may be subject to AMT tax at exercise on the value between the share value price and the exercise price. During a down round, the employee may be able to exercise more options before hitting the AMT tax threshold. Please be mindful that sometimes there are exercise lock out periods and other restrictions.

- Public Companies: Very similar to private companies; however, their valuation fluctuates minute by minute on the public exchanges. During these decreases in stock price, stock option holders may want to exercise shares when they feel the price will be “low & optimal”. Again, this is always a risk since you are going off of a feeling in one particular stock. If you are sure you can take the risk, this may be an opportunity for you. Generally, public company tech employees can exercise their options outside of a trade window. If you see your stock price is falling a decent amount, you may want to consider exercising options.

What if you already exercised early this year? Keep in mind that the AMT is an annual aggregate calculation. All ISO exercise value goes into the AMT calculation. One strategy is to sell previously exercised shares from the current year (which makes this a disqualified disposition treated as ordinary income and remove them from the AMT calculation). This may allow you to exercise a greater amount of ISOs at the same level of cash outlay if you are above the AMT tax thresholds. We recommend working with your tax advisor to complete this strategy.

Should I exercise non-qualified stock options (NQSOs) in a down market?

The philosophy behind this exercise is similar to the ISOs, but with the added complexity of taxes due at exercise. Remember, NQSOs will generate income once they are exercised and will be subject to required withholding taxes. Then, at your tax return time, you may owe additional taxes if your effective tax rate is higher than the taxes withheld at exercise.

It may make sense to exercise a small amount of NQSOs if you do not have ISOs, but be ready for the taxes due at exercise. If you have ISOs, you may be able to achieve more shares held through focusing on exercising ISOs instead.

Should I be selling my vested company stock / RSUs?

If the vest just happened, then yes, you should deeply consider it. This should be part of your strategy to diversify out of your company shares and into a well maintained portfolio that can do more work for you longer term.

For older shares, I would ask you at what price you are willing to part with it? If the stock was that price after vest, then why didn’t you sell it then? We often feel we know our company much better as an ‘insider’ and that the stock price will definitely reach $X or in three years will get to $Y. The number of times I’ve heard this, and it never got to that point, is very high. We don’t always know what the stock market will do in a shorter term because large players are pricing in their expectations as well. Leading to short term noise and erratic behavior. This down market has certainly shown that volatility time and time again 🙂

We believe in dollar cost-averaging out of company stock over time by selling RSUs at vesting. So at the least, consider selling pieces over time so you are not left wishing you had taken some off the table and less risk with your nest egg.

The above discussion is for informational purposes only. Recommendations are of a general nature, not based on knowledge of any individual’s specific needs or circumstances, and there is no intent to provide individual investment advisory, supervisory or management services.

What to do with stock options at termination

Stock options (ISOs or NQSOs) generally expire 10 years from the date of grant. This makes sense most of the time as the majority of startups aim to go public or exit within that time frame. What we don’t think about is what happens to stock options at termination.

This isn’t the only time you may be wondering what to do. Stock options add to the fun at:

- Termination

- Expiration and the company is still private

- Massive stock growth since grant

This post will discuss what to do with stock options at termination – when you are looking at leaving your job and moving on to the next opportunity.

Expiring Stock Options at Termination

In the recent month, big vests are occurring for many tech companies and tech professionals seem to be reconsidering where they want to be. Add on ‘The Great Resignation’, and your new ideal may be totally different than what you previously thought possible.

When you terminate your position, you generally have 60 to 90 days to exercise vested stock options. Your choices will be different depending on whether you are at a public company or privately held company.

For a Public Tech Company

Stock options in a public company have the value of being liquid due to an exchange you can easily trade them on. You can choose to exercise and hold, exercise and sell a bit later, or do a cashless exercise.

Since you are no longer an ‘insider’ any trading windows would no longer be applicable for future sales.

This is far less complex.

For a Pre-Exit Tech Company

This is far more difficult. If you haven’t exercised options before, you may be sitting on quite a bit of value and the company may or may not allow you to engage in a secondary market sale.

On the one hand, if you exercise your expiring stock options now, the stock will become ‘paper money’. ‘Paper money’ is basically stock in name that is highly illiquid with no known value in between. If the options are NQSOs, you will be paying tax on the value between the 409(a) and the exercise price as if you received that in cash. Ouch.

On the other hand, if the company does well, then the stock may grow to give you a huge payoff.

What to do?? This is a high risk, high value trade-off in the startup cycle. How much cash out of pocket are you willing to lose? Since this is a bit of a crap-shoot on when it becomes liquid and if it turns into something, we keep the cash in hand trade-off front and center.

Some tech professionals consider a loan to exercise the shares. Firms like ESO may offer liquidity now for a piece of the shares at exit. If you are considering this, read the fine print in the deal and consider your ‘cash out of pocket’ as what they could come to you for if it doesn’t turn out as hoped.

If the company allows a secondary market sale, it may be a bit easier. You will be able to exercise/sell some to offset the exercise and hold of others (if that makes sense based on your financial situation). In this situation, we do like to do both around the same time so that you have a ‘known’ market value for the Form 3921 (exercise of stock options). Otherwise, if another sale occurs closer to your exercise, your stock price may jump up and cause you to pay even more AMT. Always consult your tax accountant or CPA when making this decision.

Another Option to Keep in Mind

Do the above ideas sound too risky to you right now? There may be one final option for stock options at termination. Over the last few years this became more and more common – negotiating for a new stock option grant.

Companies like AirBnB and WeWork who saw some turmoil in the moments leading up to an exit were kind enough to recognize:

- You worked hard for the company with a promise of stock as part of your ‘compensation’

- You should not have to stay at the company to finally get that value

- They may be able to get a longer transition period from you at leaving

In this current down market, many tech professionals are jumping to perceived safety in another job. If you are negotiating to leave your job, bring up the above points and asking for a revised stock option agreement. I am making a bit of an assumption – that you were critical to the success of the company over your lengthy tenure so you have the leverage. 🙂

If you have ISOs, they will most likely be forced to become NQSOs due to the IRS rules around total value. For ISOs or NQSOs, the strike price will become the most current value (so higher). The deal won’t be totally equivalent to your prior grant, but it does allow you to participate in some of the growth longer term with no immediate downside.

A little catch in this – the new stock agreement will show the strike price at the current market value. This may also mean that granted ISOs may not be able to meet the ‘$100K in value’ rule and your new agreement could be NQSOs only.

So if you do have some cash you’d like to put towards your stock options at termination, you may want to exercise some ISOs before bringing this negotiation tactic to the table.

There are so many options (pun intended) when you are looking at leaving your company. I hope that you look forward to a better position that aligns with your values and allows you to grow. As always, consider each opportunity to lean into your ideal financial life with care and try not to overextend yourself. Mistakes in stock option calculations can be so costly and disheartening.

If you are struggling with these decisions and how they fit into your financial life, please reach out to us to schedule an introductory chat. Our passion in life is to help guide and partner with our clients for a better financial future that allows you to live into your values.

The above discussion is for informational purposes only. Recommendations are of a general nature, not based on knowledge of any individual’s specific needs or circumstances, and there is no intent to provide individual investment advisory, supervisory or management services.